Money generated from service or investing is known as income. Passive or residual income is also possible. Although the terms passive and residual are somehow used synonymously, they are still different.

A business can generate passive income with little to no continuous work. An individual or corporation’s earnings left over after meeting obligations depend on their residual income.

This analysis will examine Residual Income to determine whether it truly offers the best opportunity for passive income.

I do want to be honest here, so…

There are countless information courses floating around the internet. Why? Because for every problem that exists, someone claims to have the solution.

And that solution is usually some oddball money-making system that tells you how to turn a casual interest – or maybe something you’re super passionate about – into sustainable, reliable income.

Just like Residual Income Ideas Review, Here’s the hard truth, though…

Most of these programs:

- Take way more time than you’re led to believe.

- They May have hidden fees

- Require you to buy multiple upsells in order to get the “real” information

But most importantly, a lot of these programs just don’t scale.

“Scale” means once you do the work to make a little money, it should get easier to make more money, not harder.

The problem is, most programs out there make it hard to make money at first, and even harder to keep making money.

In other words, you might be able to make some money initially, but it won’t be sustainable and you’ll end up getting discouraged.

This is the exact opposite of passive income.

When income is truly passive, you do the work upfront, but then you set it and forget it. The money gets made whether you’re working or not. It’s not directly tied to the hours you put in.

So, what if there was a way you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Inventory

- Selling to friends and family.

- Selling to strangers

- Recruiting people

- Dealing with questionable products that weigh on your conscience

An income stream that brings in consistent revenues every single month (from a couple of thousand dollars to well over $10,000)?

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing, selling, or managing anything?

If that sounds like something you’d be interested in, check out Digital Leasing.

This is nothing like best passive income opportunity, and that’s probably a good thing.

However, if you’d still like to know more about Residual Income Ideas, keep reading.

What Is Residual Income?

After the work that generates the revenue process, you will achieve a residual income. It comprises making money from continued sales of consumer items, interest, dividends, and rental or real estate income (like music, digital art, or books). After all capital expenses have done paying, residual income will know in corporate finance.

Residual income, used in personal finance, refers to the funds left over after all debts and obligations settle.

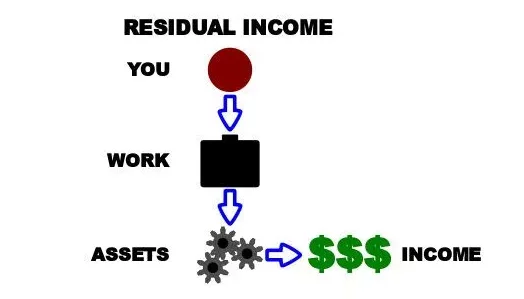

How Residual Income Works

Residual income is a net income measurement that considers all capital outlays required to generate that income. Other names for residual income include economic profit, value-added, and abnormal earnings.

Types Of Residual Income

Equity Valuation

Residual income is net income minus a cost of capital charge. The equity charge knows by multiplying the equity capital’s value by either the required return on equity or the equity price. A corporation may have a positive net income yet a zero due to the opportunity cost of equity.

Corporate Finance

After paying all capital expenses to produce revenues, managerial accounting defines residual income as the remaining operating profit.

It is also known as net operating income for the company or gain above the needed rate of return. To assess a team, department, business unit, or capital investment.

The residual income formula is Operating income – (minimum required return x operating assets).

Personal Finance

Residual income is known as disposable income in finance. The remaining revenue is determined each month after all debts are settled. As a result, obtaining a loan frequently requires having residual income.

A lender analyzes the remaining revenue each month after paying off other obligations. A loan with more residual revenue is more likely to be approved by the lender. The residual income of a Borrower shall be adequate to meet the Monthly Loan Payment.

What Is Passive Income?

Individuals or organizations can make passive income through investments or peer-to-peer lending with little to no work. According to IRS, the company you have no connection with will give you money.

The spare time saves from passive income intended for activities other than employment. Although creating a passive income stream can be dangerous but provides more monetary security. Generating passive income can offer great stability because it is not dependent on your time.

If you can’t quit your day job, it’s nice to have a side hustle to supplement your income. If you have a bunch of debt or a family member is ill, moving more of your annual income to a passive source may improve your quality of life.

Investing in a rental property is an example of passive income because investors are not actively involved in managing it. A stock that pays a yearly percentage as a dividend is another illustration. To reap the benefits of passive income, an investor must first buy the stock.

10 Passive Income Ideas

It would help if you eventually made an initial investment to generate passive income from these types of revenue. Don’t worry; many of these concepts may be launched for as low as $5, making them affordable for everyone.

1. Dividend Stocks

An established and legitimate technique to generate passive income is through dividend stocks. You’ll need money invested and conduct many studies if you want to receive large dividend payments. But by continually making dividend stock investments, you can create a high residual income.

Create an account at the best online brokerage to benefit from these investment opportunities and get incentives.

2. Rental Properties

A rental property’s monthly income is excellent. Employ a property management company to make this truly passive.

Previously, it was a challenging undertaking, but the internet has made it a. There are many ways to invest in rental homes, depending on your objectives and interests. You can purchase homes, rent them out online, or invest in sizable residential or commercial properties!

Invest In Single Family Homes

A more traditional real estate investment option is rootstock. With this organization, you can buy online single-family rentals with a good income flow! Register right away to begin looking for properties.

Invest In Larger Developments

Would you rather make real estate investments without becoming a landlord? The possibility of a limited partnership is another choice. They let you purchase commercial or multi-family properties. You get the same tax advantages and income benefits as typical property owners, but without doing any labor!

Invest In Farmland

Although farmland isn’t particularly attractive, much is happening in real estate investing. Everyone needs food, it’s reliable, and it pays the rent. Additionally, compared to other real estate kinds, it is less variable.

3. High Yield Savings Accounts And Money Market Funds

If you don’t want to think your money, a high-yield savings account or money market fund are great options.

The location and account type is different.

Most high-yield savings accounts are FDIC insured and located at banks. Money market funds are available at banks and investment companies and are rarely FDIC insured.

Savings rates are rising, so putting more money in savings can generate a steady passive income.

4. CD Ladders

Creating a CD ladder involves buying CDs (certificates of deposit) from banks in increments to result in a return maximize. Banks give CDs, which are low-risk investments with low returns. This option is much safe.

For example, for a five-year CD ladder, do the following. Look how the rates rise over time (estimated):

- 1 Year CD – 2.50%

- 2 year CD 2.90 %

- 3 Year CD 3.05 %

- 4 Year CD 3.10 %

- 5 Year CD 3.15 %

If constructing a CD ladder seems complicated, you can opt for a high-yield savings account or money market fund. But it’s better than nothing and a decent passive income!

5. Annuities

You purchase annuities, a type of insurance, and then start receiving monthly payments for the rest of your life. Before buying an annuity, it is advisable to speak with a reputable financial counselor because annuity terms might vary and aren’t always advantageous.

Not everyone should invest in these things, and the fees might be substantial. However, if you have no tolerance for risk and are seeking a passive income source, this can be an excellent investment for your portfolio.

6. Invest Automatically In The Stock Market

There are still methods to invest passively in the stock market if you don’t want to select dividend-paying stocks (which I understand). You can invest automatically in many ways with a Robo-advisor.

A Robo-advisor is what it sounds like: an automated financial advisor. The system takes care of the rest once you spend around ten minutes completing a few questions and creating your account.

7. You Can Invest In A REIT (Real Estate Investment Trust)

It’s acceptable if you’re hesitant about making a direct real estate investment or if you aren’t yet an accredited investor. In your investing, you can still employ real estate through REITs or Real Estate Investment Trusts.

These are real estate-holding investment vehicles. Gains, sales from refinancing, and income (or loss) from the property benefit you as the owner.

8. Invest In A Business

Passive income produces by investing in a company as a silent partner. High danger levels accompany high reward levels. For instance, a few years ago, Lyft and Uber looked for private investors for their companies.

Their current worth is in the billions, but as an investor, you will only gain if they are acquired or become public through an IPO. So, this is a risky undertaking.However, there are methods to lessen your chances. If you lend a small amount of money to many companies, you can invest in their stock in small amounts.

Thanks to new tools available, you can now lend money to a business and get paid handsomely for it.

9. Invest In Student Income-Share Agreements

An Income-Share Agreement can replace a substitute for student loans (ISA). If a student uses an Individual Retirement Account, their tuition intends for a share of their future earnings (IRA).

These ISAs pay in what way? Universities and private investors invest in them. It is a financial commitment to somebody’s future.

Coding and trade schools are the most common places to find these, but they are becoming more widespread.

10. Refinance Your Mortgage

Refinancing your mortgage can save money over the loan and release a sizable amount of cash. It may seem strange in a piece about residual revenue. That’s a really good gain, in my opinion.

Interest rates are typically very close to historic lows, so if you haven’t lately compared your mortgage rates, now is a wonderful time to do so. You may save thousands of dollars by lowering your interest rate by half a percent. It is a great investment for you.

Is Residual Income Ideas A Scam?

So, is Residual Income Ideas a scam? Not technically. You can make money with this program, but it’s definitely not as easy as Residual Income Ideas,make it sound.

There’s a ton of work to be done upfront, no real guarantee of success, and – most importantly – it doesn’t scale.

There’s nothing wrong with front-loading the work and making the money later.

But if you’re grinding it out for 3 months and then your reward is being forced to grind it out for another 9 months before seeing any “real money,” well…that’s not a great deal, is it?

What if, instead, you could do that same 3 months of work (in your spare time), and your reward was a $500 to $2,000 payment that came in every single month?

And what if you actually didn’t need to wait 3 months? What if you could get started today and have your first payment in a week?

And what if you could double it next week?

Well, that’s the power of Digital Leasing.

And you can legitimately do this from anywhere. It’s a true lifestyle business.

Your laptop and an internet connection is alareyou need.

Some of the most successful students in this program run their entire 6-figure businesses from:

- A camper in the middle of the woods

- A beach chair on the water in Mexico

- A small villa in Greece

They’re able to travel around, living their lives first, and focusing on their income second.

Because even if they stop working for an extended period of time, the money keeps coming in.

So adventure, memories, and experience are the top priority.

And they never have to worry about how to pay for the next trip, or consider asking for time off.

If this sounds more like the type of life you want to lead, just click here to find out more about Digital Leasing.

Are There Alternatives To Residual Income Ideas?

Yes, there are plenty of other business models to choose from if you want to pursue making money online. Here are just a few:

What Is My Top Recommendation In Making Money Online In 2024?

Our review team has spent months researching, reviewing, and vetting dozens of business models and thousands of programs.

While there may be no “perfect business”, the research IS conclusive:

Digital Leasing is the #1 online business model for those just starting out.

Whether you’ve never made a dollar online, or you’ve been in this space for a while but never really “made it,” Digital Leasing is for you.

Why?

1) It’s Flexible: got an hour a day? You can do this. Ready to drop everything else and dive in full time? You can do this. Yes, the more time you put in, the faster you see results. But even with a little time each day, you can move the needle in a Digital Leasing business.

And because this system is so flexible, you don’t have to constantly be working to make more money. It’s called PASSIVE INCOME because if you stop working, the money doesn’t.

Imagine taking 3 months off to just tour around Europe, rent a cabin in the woods to write a book, hike the Appalachian Trail, or live on the beach and surf all day.

This is only possible if you have an income stream that’s not tied to your time.

2) You Own & Control EVERYTHING: With best passive income opportunity, you don’t really own anything. You have no control over the quality of products. You don’t even own your “business”.

Look at the fine print for most of the agreements folks sign when they join one of these companies. At any point, the company can change your commission structure, reduce your profit margins, or kick you out entirely.

With Digital Leasing, you own the assets, which means you have all the power and all the control.

3) Little To No Startup Costs: It’s possible to get into Digital Leasing with zero dollars upfront. Because, using the strategies outlined in this program, you can get a client to pay you BEFORE spending a penny out of your own pocket…even before you do any work.

Even without getting paid in advance, you can have your first Digital Rental Property up, running, and generating profits for less than $100.

4) Easy To Duplicate: Ok, here’s the best part: once you have your first Digital Rental Property up and running, you can literally DOUBLE your income with a few clicks, a couple keystrokes, and a single phone call (and you don’t actually need the phone call).

Remember: each Digital Rental Property is worth $500 to $2,000 a month in semi-passive income (over 95% profit). Every time you decide to create another one and increase your income, it gets easier.

Because you have more knowledge, more experience, more results, and more momentum.

If you wanted to double your income with Residual Income Ideas, you’d probably need to double the number of hours you spend working. Because, again, this program doesn’t scale.

5) Make Money Helping Real People: With Digital Leasing, you’re actually helping people by solving your clients’ biggest problem:

Small, local businesses need more customers, and with Digital Leasing, you are unleashing a flood of happy, paying customers for these businesses.

You make money by helping them make money.

Not a big, faceless corporation either…a small business owner who’s using that money to put food on the table for their family, start a college fund for their kids, or take care of a sick parent.

Once you see how Digital Leasing makes a real impact in the lives of real people, you’ll sleep like a baby with a big smile on your face.

Now, the choice is yours. You could continue browsing, looking at opportunities like Residual Income Ideas, which could one day make you money.

You could continue researching, never making a decision.

OR, you could take a look inside, consider what you really want, and join a program that makes your dreams a reality. At the same time, joining a community of over 2,000 successful students that are living life on their own terms thanks to Digital Leasing.

A consistent, reliable, semi-passive stream of income that doesn’t depend on you or your time to keep producing profits.

All while genuinely helping real people who are grateful and happy to pay for it.

If this sounds more like what you want out of life (or if you just want some nice side income), click here to learn more about Digital Leasing.