Looking for something to help you trade in stocks? Luckily, I’ve got the thing for you.

Whether you’ve been trading for years and are just getting started, you can still profit from the assistance of a platform that can help you keep up with the fast-paced nature of the trading industry in today’s day and age.

This is exactly what the Tradestops software from TradeSmith is intended to do.

You are meant to get a notification whenever anything significant occurs that affects the decisions you make. It does this by using several optimization techniques.

Let’s give TradeSmith a go and see whether it’s worth our time to try it. Let’s find out together as we go through this review.

Although before we begin, let me first be honest with you.

You probably discovered TradeSmith for the same reason you might have come across any other financial newsletter, stock trading service, or investment program:

Because you want more money in less time.

And chances are, you want to quickly multiply the money you do have (as opposed to waiting months or even years to see a decent ROI).

This is a really exciting promise, and it’s probably why the financial publishing and training industry is worth billions of dollars.

The problem is, because the idea of doubling, tripling, or 10X-ing your money in a few minutes to a few days is so enticing, there are a ton of shady characters in this space.

But, putting that aside, let’s say every investing guru and “trading expert” on the internet had the best of intentions.

Even with proprietary algorithms, a room full of supercomputers, and a team of rocket scientists, most of these experts would be lucky to get it right 20% of the time.

Now sure, we’re talking about asymmetric bets here, so theoretically the winners should more than make up for the losers.

But in order to make that happen, you can NEVER miss a trade. With a 20% success rate (speaking optimistically), one missed winner could turn a profitable month into a loser.

That’s a lot of pressure and a lot of stress (not to mention a lot of losing) with not much certainty.

But what if there was a way you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Constantly monitoring your phone for buy/sell alerts

- Obsessively watching charts and movement

- The emotional roller coaster and angst of hoping one winner can cover the last 8 losses

- Gambler’s odds (20% chance of success is worse than the odds of winning at Blackjack)

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day monitoring charts, trades, and alerts?

<INSERT “STILL GETTING PAID”>

If that sounds like something you’d be interested in, check out Digital Leasing.

However, if you’d still like to know more about TradeSmith, keep reading.

What Is TradeSmith?

The trading platform known as TradeStops was developed by the company TradeSmith, along with many other services.

The organization, which has its roots in Maryland and is now headquartered in Baltimore, has seen significant expansion since it was established in 2011.

This growth has resulted in incorporating numerous useful features, such as risk management and portfolio analysis tools, amongst others.

With its help, investors may enhance their ability to build wealth, refine their investment approach, and profit from market opportunities.

TradeSmith products include:

- Crypto by TradeSmith

- Trade360

- TradeSmith CoPilot

- TradeSmith Decoder

- Ideas

They got high-quality research tools and analysis, but at different price points and for other aspects of the stock market.

With this, there are many TradeSmith reviews online that praise this company.

Who Owns TradeSmith?

Richard Smith first established TradeSmith, but later, he decided to sell the business to an unidentified financial publisher for a price that was not revealed.

An Overview Of TradeStops And Ideas From TradeSmith

Dr. Richard Smith, a mathematician, and investor, is the creator of two products that are unique from one another but are connected.

These products are TradeStops and Ideas by TradeSmith.

Investors who wish to have risk management tools in their stock portfolios may consider these items.

TradeStops analyzes the risk associated with stocks and rebalances portfolios depending on the history of market volatility.

On the other hand, traders may use Ideas to develop multi-portfolio investments or stock ideas based on various investment approaches and stocks held by multi-portfolio investors.

Pricing Options

Both TradeStops and Ideas are offered for sale individually, and there is no opportunity to purchase both at a discounted fee.

TradeStops has a $79 monthly fee after a free trial period of 30 days, while Ideas has a $99 monthly fee.

TradeStops Features

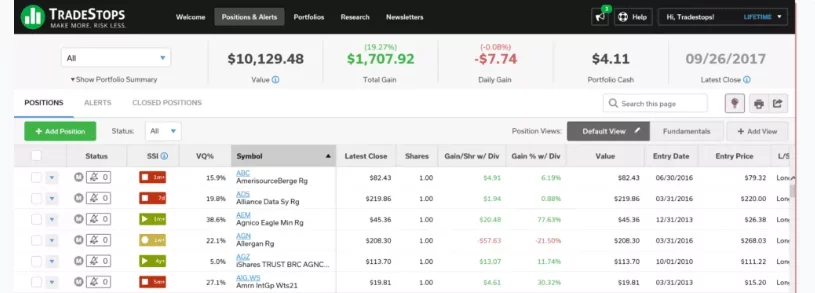

Volatility Quotient And Stock State Indicator

When determining the level of danger posed by each stock in a portfolio, TradeStops relies on the volatility quotient (VQ) and the stock state indicator (SSI).

The VQ assigns a percentage value to the volatility of a specific stock to calculate how far below the current price a following stop loss should be put.

This is done to prevent stop loss from occurring too soon.

In addition, it computes the greatest possible loss that may be incurred on a particular stock when trailing stops are used.

The SSI is a green-yellow-red indicator determining if a stock has recently triggered an entry or exit signal. It determines whether the arrow is green, yellow, or red.

The VQ and SSI are calculated in real-time for every stock held in a TradeStops-monitored portfolio.

They are the foundation upon which the more sophisticated risk management solutions and wealth creation skills of the platform are built.

Position Size Calculator

With VQ, trailing stop calculations, and traders’ risk appetite, the position size calculator, estimates the best price to purchase any given stock.

Before using the calculator, traders must determine the maximum amount of funds they are willing to put at risk on a single trade.

The result displays the maximum amount invested together with the first stop loss value.

In addition, TradeStops explains the results in English.

This makes it much simpler to understand how the calculator arrived at its conclusions and how altering the parameters might affect the result.

Asset Allocation And PVQ Analyzer

TradeStops’ asset allocation tool has been around for some time and works as a supplement to the company’s other portfolio analysis tools.

The asset allocation tool shows traders how their assets are split throughout the major market industries and sectors.

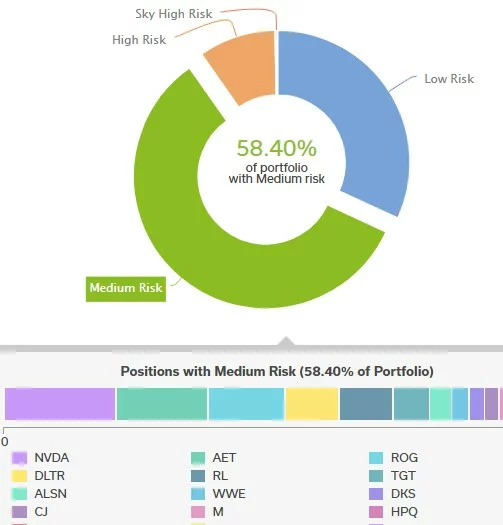

Instead of classifying assets according to the market sector, the PVQ analyzer does it based on risk (VQ). Investors may easily recognize the portfolio’s risk level by using this tool.

Furthermore, this tool may be used across various portfolios, which is beneficial for investors with a mix of risk-hazard and safety investments.

Risk Re-balancer Tool

The risk re-balancer uses VQ across multiple portfolios to assist investors in lowering their average VQ.

A change in the number of shares of current assets can significantly reduce total risk potential.

Importantly, the risk re-balancer tool lets you lock some holdings and exclude others from the analysis.

Alerts

The monitoring of portfolio activity in TradeStops depends heavily on using Alerts, which may be set in a wide variety of ways.

A threshold surpassed by VQ is one example of a scenario that might trigger an alert, as can a percentage change or a change in the status of a stock’s SSI.

Traders are given the capability of setting alerts centered on trailing stops thanks to the price-based notifications that can be enabled via TradeStops.

Ideas Features

Market Risk

Ideas is certainly one of the most user-friendly and informative platforms for financial news and analysis platforms, making it ideal for both traders and investors interested in the short- and long-term.

The tool separates the market into its key categories. It displays the percentage of stocks that are high risk (shown in red), medium risk (shown in yellow), or low risk (shown in green) based on their volatility quotients as well as their calculated entry and exit points.

So you can see how risk has changed historically and where the indices are with their one-year highs and lows.

The Stock Finder also shows traders which stocks fall into each risk category.

Ideas go beyond the major indices, breaking down risk for stocks by market sector and commodities.

Stock Finder

A stock screener, the stock finder tool has features based on VQ, SSI, and Dr. Smith’s Lab portfolio categories.

Since the stock finder only has a limited number of technical and fundamental filters, traders must be completely dedicated to discovering trade ideas based on VQ and possible risk.

Integrating TradeStops And Ideas

Ideas and TradeStops are designed to work together, although each product is advertised and sold separately.

When a user has login information for both the Ideas and TradeStops platforms, the Ideas platform makes it extremely easy to export stocks to a new portfolio. Then that portfolio is instantly transferred over to TradeStops.

Traders who want to make a new portfolio using Ideas need only to click the box next to each stock in the stock finder results or Dr. Smith’s Lab that they want to include in the new portfolio.

The idea is that traders and investors can uncover possible new stocks to trade inside Ideas and then observe how those stocks operate within a new or existing portfolio via TradeStops.

Traders can use TradeStops’ risk rebalancing and position size tools to determine how many shares of new stock to acquire while maintaining their portfolio’s risk profile.

Who Should Use TradeStops

Investors who manage one or more portfolios will find this method quite useful.

It would also be useful for medium-term investors trying to enhance their risk management and portfolio allocation techniques.

On the other hand, the typical trader will find that TradeStops is somewhat pricey. Therefore, investors that have large portfolios are the ones who are more likely to use them.

TradeStops is often used with Ideas, a product of TradeSmith. Using the integrated stock finder, you may research and select potentially profitable stocks for your portfolio.

TradeStops can then monitor and manage the portfolio. TradeStops and Ideas together form a complete portfolio management solution.

Is Tradesmith A Scam?

So, is Tradesmith a scam? Not technically. You can make money with it, but it’s definitely not as easy as Richard Smith makes it sound.

Again, with any kind of financial product (especially trading), you’re taking on a lot of risk.

Sure, you could hit it big and retire in Italy, but chances are you need the stomach and financial cushion to weather tons of losses before you get there…and it may never happen.

Most of the big gains numbers these companies use in their marketing (“xyz grew by 4,112% in 3 months” or “this option made 324% in just 2 days”) are cherry-picked.

They don’t tell you about the 10 100% losers that came before.

In other words, if you invested $100 into 11 recommendations, you’d lose $1,000, and make back $324…so you’d still be out almost $700.

Most people don’t have the fortitude to stick it out through 3 straight months of losers in the hopes of landing one big winner.

What if, instead, you took those same 3 months, invested just a couple hours a day (in your spare time), and your reward was a $500 to $2,000 payment that came in every single month?

And what if you actually didn’t need to wait 3 months? What if you could get started today and have your first payment in a week?

And what if you could double it next week?

Well, that’s the power of Digital Leasing.

It’s a true lifestyle business.

Your laptop and an internet connection is all you need.

Some of the most successful students in this program run their entire 6-figure businesses from:

- A camper in the middle of the woods

- A beach chair on the water in Mexico

- A small villa in Greece

They’re able to travel around, living their lives first, and focusing on their income second.

Because even if they stop working for an extended period of time, the money keeps coming in.

So adventure, memories, and experience are the top priority.

And they never have to worry about how to pay for the next trip, or consider asking for time off.

If this sounds more like the type of life you want to lead, just click here to find out more about Digital Leasing.

Are There Alternatives To Tradesmith?

Yes, there are plenty of other business models to choose from if you want to pursue making money online. Here are just a few:

What Is My Top Recommendation In Making Money Online In 2024?

Our review team has spent months researching, reviewing, and vetting dozens of business models and thousands of programs.

While there may be no “perfect business”, the research IS conclusive:

Digital Leasing is the #1 online business model for those just starting out.

Whether you’ve never made a dollar online, or you’ve been in this space for a while but never really “made it,” Digital Leasing is for you.

Why?

1. It’s Flexible: got an hour a day? You can do this. Ready to drop everything else and dive in full time? You can do this. Yes, the more time you put in, the faster you see results. But even with a little time each day, you can move the needle in a Digital Leasing business.

And because this system is so flexible, you don’t have to constantly be working to make more money. It’s called PASSIVE INCOME because if you stop working, the money doesn’t.

Imagine taking 3 months off to just tour around Europe, rent a cabin in the woods to write a book, hike the Appalachian Trail, or live on the beach and surf all day.

This is only possible if you have an income stream that’s not tied to your time.

2. You Own & Control EVERYTHING: With anything in the financial markets, you own and control NOTHING. You have no say in price fluctuations, demand, or what the market will do.

Trying to beat the market is fighting against the tide. There’s just too much working against you, no matter how many supercomputers or rocket scientists are on your side.

With Digital Leasing, you own the assets, which means you have all the power and all the control.

3. Little To No Startup Costs: It’s possible to get into Digital Leasing with zero dollars upfront. Because, using the strategies outlined in this program, you can get a client to pay you BEFORE spending a penny out of your own pocket…even before you do any work.

Even without getting paid in advance, you can have your first Digital Rental Property up, running, and generating profits for less than $100.

1. Easy To Duplicate: Ok, here’s the best part: once you have your first Digital Rental Property up and running, you can literally DOUBLE your income with a few clicks, a couple keystrokes, and a single phone call (and you don’t actually need the phone call).

Remember: each Digital Rental Property is worth $500 to $2,000 a month in semi-passive income (over 95% profit).

Every time you decide to create another one and increase your income, it gets easier.

Because you have more knowledge, more experience, more results, and more momentum.

If you wanted to double your income with any kind of trading or investing, you’d have to double your initial capital OR double the average order size of your existing trades.

And, guaranteed that’s a lot harder than a few clicks and a few minutes of your life.

2. Make Money Helping Real People: This part is what makes it all worth it. In the financial markets, you might be helping your family, but the impact never goes beyond you and maybe a few others.

But with Digital Leasing, you’re actually helping people by solving your clients’ biggest problem:

Small, local businesses need more customers, and with Digital Leasing, you are unleashing a flood of happy, paying customers for these businesses.

You make money by helping them make money.

Not a big, faceless corporation either…a small business owner who’s using that money to put food on the table for their family, start a college fund for their kids, or take care of a sick parent.

Once you see how Digital Leasing makes a real impact in the lives of real people, you’ll sleep like a baby with a big smile on your face.

Now, the choice is yours. You could continue browsing, looking at opportunities like Tradesmith which could one day make you money.

You could continue researching, never making a decision.

OR, you could take a look inside, consider what you really want, and join a program that makes your dreams a reality.

At the same time, joining a community of over 2,000 successful students that are living life on their own terms thanks to Digital Leasing.

A consistent, reliable, semi-passive stream of income that doesn’t depend on you or your time to keep producing profits.

All while genuinely helping real people who are grateful and happy to pay for it.

If this sounds more like what you want out of life (or if you just want some nice side income), click here to learn more about Digital Leasing.