Origin Investments’ mission is to let accredited investors acquire passive access to certain real estate markets. By using their Origin Investments account, you will have the chance to have personal financial advice, real estate investment funds, and real estate assets.

With a $100,000 minimum commitment, it is clear that they are primarily interested in high-net-worth people.

Origin investments work as they use their own money in projects alongside investors, connecting their interests with yours.

Even though it’s really amazing, is this the best one for you?

Check it out in this Origin Investments Review!

But before that…

Origin Investments is a real estate investing program.

Like most real estate investing training courses, you’ll likely be exposed to the “Big 3” investing types:

- Flipping

- Wholesaling

- Long-term buy-and-hold

Regardless of which path you go down, there is a lot of potential with real estate investing.

After all, it’s the world’s oldest wealth-builder.

However, before you leave this Origin Investments review and go sign up, you might want to ask yourself:

“Is now the right time for me to get into real estate investing?”

Because, no matter which way you slice it, real estate investing is extremely capital intensive, labor intensive, or both.

So if you’ve only got an hour or two a day, or your savings account is a few zeroes lighter than you’re comfortable with, this might not be the best time for you to jump into real estate investing.

But that doesn’t mean you’re out of luck. It just means you need a system to free up more time and give yourself a stronger financial cushion.

A good way to get yourself there is with Digital Leasing.

Digital Leasing takes all the best parts of real estate investing, while eliminating most of the headaches:

- Low cashflow

- Interest payments

- Mortgages

- High overhead

- Expensive repairs and maintenance

- Problematic tenants

And the best part?

Digital Leasing allows you to build a passive income stream that’s actually passive!

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000).

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day analyzing deals, cold-calling homeowners, or dealing with contractors.

If that sounds like something you’d be interested in, check out Digital Leasing.

This is the perfect first step to build recurring income that you can then use to start investing in real estate down the line.

However, if you’d still like to know more about Origin Investments, keep reading.

What Is Origin Investments: A Real Estate Investment Company?

Origin is a commercial real estate investment firm that invests in commercial buildings around the United States. Since its inception in 2007, Origin Investments has raised and presently manages more than $700 million in commercial and multifamily properties in eight U.S. regions.

These markets have a high potential for property value increase. Atlanta, Austin, Charlotte, Chicago, Dallas, Denver, Houston, and Raleigh are among them.

Origin Investments offers these markets based on several criteria, including:

- Population growth

- Potential job growth

- Increases in the average rent

- Access to public transportation

- Proximity to universities to recruit a trained workforce

Office buildings and multifamily residential real estate units are examples of real estate investment options. They have purchased and managed over 60 homes so far.

Origin purchases real estate without the assistance of a broker. This allows them to save money on broker commissions.

At the same time, as a real estate company, Origin contributes some funds to the pot. Too far, David Scherer and Michael Episcope have co-invested more than $56 million in their deals. As a result, investors’ and Origins’ motivations are matched.

Funds Vs. Shares

It is critical to note that Origin investors buy into a fund rather than individual properties. The minimum investment might be significant, ranging from $100,000 to $500,000.

However, when you sign up with Origin, you will not encounter any hidden costs, perplexing systems, or complicated offers.

The capital requirements are clearly given out from the start, so there will be no surprises once you designate your initial minimum investment amount.

Transparency

Origin Investments believes in providing total transparency to its investors and provides detailed information on each project housed in their funds.

Origin isn’t hiding anything from investors, from financial data to overall investment strategy.

Investors will also attend monthly webinars on the funds they have invested in receiving updates and information.

This type of behind-the-scenes glimpse is uncommon from crowdfunding platforms, but it is essential to investors.

Origin Investments Fee Structure

In addition to other fees, Origin charges its investors a 1.25 percent annual management fee on their net asset value.

Depending on the fund, they may include an acquisition fee, an administration fee, or other charges.

If your initial investment is less than $250,000, for example, a 2% one-time administration fee will be charged.

In addition to this cost, Origin charges a performance fee on both of its funds. These fees are only charged if the funds return more than a specific chosen level.

The remainder of the returns above the threshold is then paid to Origin.

The Origin IncomePlus Fund charges a 10% performance fee after a 6% preferred return with a 50/50 catch-up.

Investors in the QOZ Fund will pay a 15% performance fee after a 7% preferred return with a 50/50 catch-up.

Accredited Investors Only

Keep in mind that to invest with Origin, you must be an accredited investor.

To be an accredited investor, you must fulfill at least one of the following requirements:

- Earn more than $200,000 per year as an individual or more than $300,000 per year as a couple. This has been true for the last two years. You should also anticipate maintaining your current level of income.

- Have a net worth of more than a million dollars, either alone or jointly with your spouse (excluding the primary residence).

- Alternatively, you must hold a professional financial license, such as Series 7, Series 65, or Series 82.

Origin Investments Vs. REIT

While the commercial real estate funds listed on Origin seem to be equivalent, they are not REITs. Origin’s real estate holdings, in fact, vary from traditional REITs in important ways:

- REITs are typically established to generate management fees. On the other hand, Origin Investments is structured to generate investment returns for both the company and all of its investment partners.

- Origin’s principals put a lot of money into their own deals. In comparison, very few private REIT managers put significant resources into their vehicles.

- Origin funds are structured as an LLC, implying that any tax benefits (such as depreciation and interest expenditure) are passed on to investors. The tax benefits are captured at the REIT level under a REIT structure. The remainder of the income is taxed at the regular income rate.

- Private REITs usually pay significant commissions to consultants to promote their products. Origin does not pay a commission to a third party to sell its investments. This translates into lower fees for its investors and more money invested in real estate.

- The majority of REIT fees are generated through transactions. Meanwhile, Origin’s fees are paid only after its investor’s profit.

- Origin Investments sends out quarterly updates to all investors and is very transparent about its investments and processes. Private REITs are not required to give investors with the same level of transparency.

Origin Investment Funds

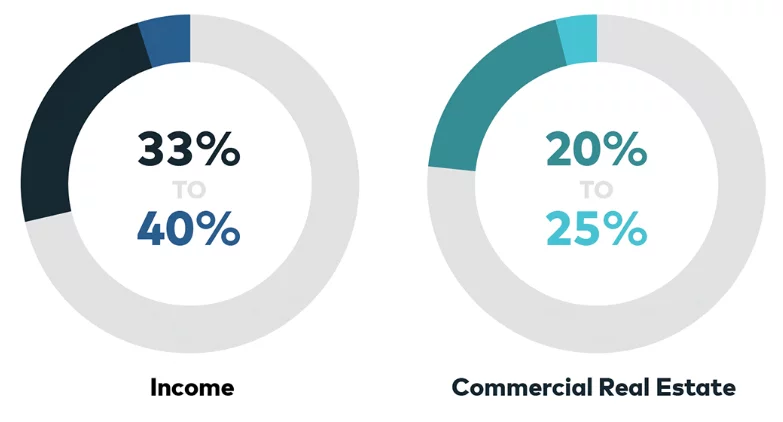

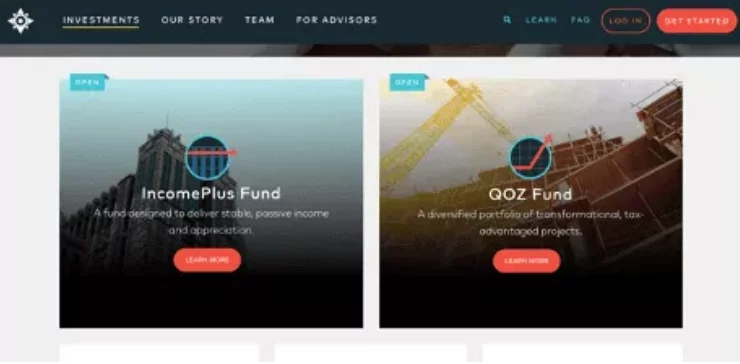

Origins Investments now offers clients the opportunity to participate in one of two unique funds. The investing strategies of the funds varies, and they appeal to a wide range of investors.

IncomePlus Fund

The Origin IncomePlus Fund is a simple private real estate fund that provides steady income, downside protection, and tax benefits to investors.

The fund aims a total net annual return of 9-11 percent, including a 0.5 percent monthly distribution (6 percent total annually).

Previous closed-end funds did not provide this level of consistent passive income. In these circumstances, Origin Investments investors typically did not get a distribution from the QOZ fund until the property had completed its whole business plan and was sold.

Real Estate Investors received from the QOZ fund their first distribution after the plan was completed. This can take 5 to 10 years to play out in certain circumstances!

Distribution Reinvestment Plan (DRIP)

You may get your distribution in one of two ways. You may accept it in cash or have it deposited straight into your bank account with Origin Investments.

You can also benefit from compounding returns by enrolling in its DRIP. This technique allows you to use the payout to purchase fresh units automatically each month. To put it another way, reinvest in the fund.

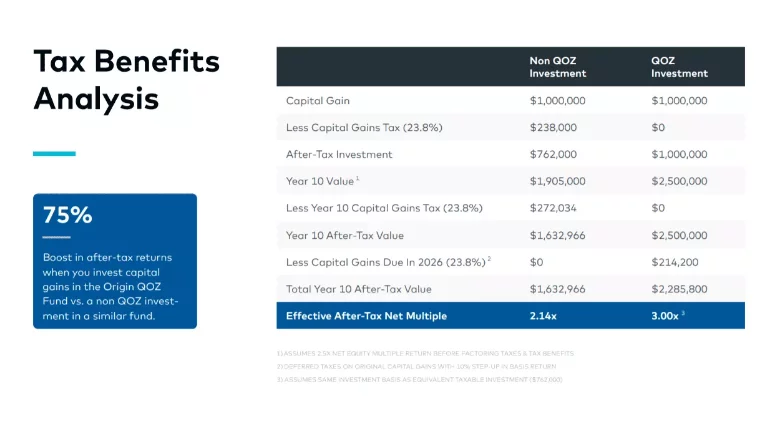

Qualified Opportunity Zone (QOZ Fund)

The Qualified Opportunity Zone (QOZ Fund) program of the JOBS Act promotes investment in certain communities that need a boost in economic development.

It provides significant tax advantages to investors who roll over capital gains from prior assets into a fund that invests in QOZs.

Origin designed this fund’s portfolio to include a mix of new development projects that will provide strong returns even before accounting for the QOZ tax benefits.

After the properties are built, Origin funds will diversify its portfolio into assets that generate continuous cash flow for its investors.

This method requires a $100,000 minimum investment.

The Origin QOZ Fund Also Has The Following Advantages:

- Tax Exemption: If held for ten years or longer, the QOZ Fund will not pay capital gains taxes.

- Tax Deferral: Defer your capital gains tax from an earlier investment until 2026.

- Tax Reduction: You can reduce your capital gains taxes by up to 15%

Is Origin Investments A Scam?

So, is Origin Investments a scam? Not technically. You can make money with this program, but it’s definitely not as easy as Gurus makes it sound.

There’s a ton of work to be done upfront, no real guarantee of success, and – most importantly – the actual profit margins on real estate investments are pretty small.

Now, there’s nothing wrong with front-loading the work and making the money later.

But if you’re grinding it out for 3 months – looking at deals, sending out offers, negotiating with the seller and lender to buy a rental property – and then your reward is like $100 a month in profits, it’s not really worth it.

What if, instead, you could do that same 3 months of work (in your spare time), and your reward was a $500 to $2,000 payment that came in every single month (with a 90-95% profit margin)?

And what if you actually didn’t need to wait 3 months? What if you could get started today and have your first payment in a week?

And what if you could double it next week?

Well, that’s the power of Digital Leasing.

And, unlike traditional real estate, you can legitimately do this from anywhere. It’s a true lifestyle business.

Your laptop and an internet connection is all you need.

Some of the most successful students in this program run their entire 6-figure businesses from:

- A camper in the middle of the woods

- A beach chair on the water in Mexico

- A small villa in Greece

They’re able to travel around, living their lives first, and focusing on their income second.

Because even if they stop working for an extended period of time, the money keeps coming in.

So adventure, memories, and experience are the top priority.

And they never have to worry about how to pay for the next trip, or consider asking for time off.

If this sounds more like the type of life you want to lead, just click here to find out more about Digital Leasing.

Are There Alternatives To Origin Investments?

Yes, there are plenty of other business models to choose from if you want to pursue this making money online. Here are just a few:

What Is My Top Recommendation In Making Money Online In 2024?

Our review team has spent months researching, reviewing, and vetting dozens of business models and thousands of programs.

While there may be no “perfect business”, the research IS conclusive:

Digital Leasing is the #1 online business model for those just starting out.

Whether you’ve never made a dollar online, or you’ve been in this space for a while but never really “made it,” Digital Leasing is for you.

Why?

1) It’s Flexible: got an hour a day? You can do this. Ready to drop everything else and dive in full time? You can do this. Yes, the more time you put in, the faster you see results. But even with a little time each day, you can move the needle in a Digital Leasing business.

And because this system is so flexible, you don’t have to constantly be working to make more money. It’s called PASSIVE INCOME because if you stop working, the money doesn’t.

Imagine taking 3 months off to just tour around Europe, rent a cabin in the woods to write a book, hike the Appalachian Trail, or live on the beach and surf all day.

This is only possible if you have an income stream that’s not tied to your time.

Flipping and wholesaling are full-time jobs (and more), no matter what any real estate guru tells you. You always have to be searching for deals, because if you stop, so does the money.

2) You Own & Control EVERYTHING: Yes, in traditional real estate you kind of “own” the properties. But there’s also a ton of debt tied to most real estate investments, which means the property isn’t truly yours.

A lender can take it away if you miss a payment. Not to mention, loan payments really impact your profit margins.

With Digital Leasing, you own the assets outright (with a 90-95% profit margin), which means you have all the power and all the control.

3) Little To No Startup Costs: It’s possible to get into Digital Leasing with zero dollars upfront. Because, using the strategies outlined in this program, you can get a client to pay you BEFORE spending a penny out of your own pocket…even before you do any work.

Even without getting paid in advance, you can have your first Digital Rental Property up, running, and generating profits for less than $100.

4) Minimal Ongoing Expenses: With traditional real estate, monthly expenses are HIGH. Between loan payments, ongoing maintenance, and repairs (not to mention the possibility of having to go through the eviction process), profit margins are slim.

Plus, whenever you have a vacancy, factor in the costs to turn over a unit (plus the fact there’s no money coming in until the next tenant moves in).

With Digital Leasing, a 100% online business with minimal maintenance and ongoing costs, you never even have to think about that risk.

5) Easy To Duplicate: Ok, here’s the best part: once you have your first Digital Rental Property up and running, you can literally DOUBLE your income with a few clicks, a couple keystrokes, and a single phone call (and you don’t actually need the phone call).

Remember: each Digital Rental Property is worth $500 to $2,000 a month in semi-passive income (over 95% profit). Every time you decide to create another one and increase your income, it gets easier.

Because you have more knowledge, more experience, more results, and more momentum.

If you wanted to double your income with traditional real estate investing, you’d have to double your monthly rent, double your deals/number of units OR double your profit margins. And, guaranteed that’s a lot harder than a few clicks and a few minutes of your life.

6) Make Money Helping Real People: This part is what makes it all worth it. With Digital Leasing, you’re actually helping people by solving your clients’ biggest problem:

Small, local businesses need more customers, and with Digital Leasing, you are unleashing a flood of happy, paying customers for these businesses.

You make money by helping them make money.

Not a big, faceless corporation either…a small business owner who’s using that money to put food on the table for their family, start a college fund for their kids, or take care of a sick parent.

Once you see how Digital Leasing makes a real impact in the lives of real people, you’ll sleep like a baby with a big smile on your face.

Now, the choice is yours. You could continue browsing, looking at opportunities like Origin Investments which could one day make you money.

You could continue researching, never making a decision.

OR, you could take a look inside, consider what you really want, and join a program that makes your dreams a reality. At the same time, joining a community of over 2,000 successful students that are living life on their own terms thanks to Digital Leasing.

A consistent, reliable, semi-passive stream of income that doesn’t depend on you or your time to keep producing profits.

All while genuinely helping real people who are grateful and happy to pay for it.

If this sounds more like what you want out of life (or if you just want some nice side income), click here to learn more about Digital Leasing.