We already know that Real Estate is one of the greatest ways to make money.

But it’s also pretty dangerous because in real estate investing we will be talking about thousands of dollars.

Mashvisor’s Property Analysis tool is a model created specifically for residential real estate investors.

This makes your property search and property sales history a little easier to handle.

Your property tax history will be in safe hands as it identifies the major categories of revenues. This also includes expenses necessary to calculate net operating income and subsequently, rates of return and cap rates.

Though is it really true?

Learn in this review.

But before that…

Mashvisor is a real estate investing program.

Like most real estate investing training courses, you’ll likely be exposed to the “Big 3” investing types:

- Flipping

- Wholesaling

- Long-term buy-and-hold

Regardless of which path you go down, there is a lot of potential with real estate investing.

After all, it’s the world’s oldest wealth-builder.

However, before you leave this Mashvisor review and go sign up, you might want to ask yourself:

“Is now the right time for me to get into real estate investing?”

Because, no matter which way you slice it, real estate investing is extremely capital intensive, labor intensive, or both.

So if you’ve only got an hour or two a day, or your savings account is a few zeroes lighter than you’re comfortable with, this might not be the best time for you to jump into real estate investing.

But that doesn’t mean you’re out of luck. It just means you need a system to free up more time and give yourself a stronger financial cushion.

A good way to get yourself there is with Digital Leasing.

Digital Leasing takes all the best parts of real estate investing, while eliminating most of the headaches:

- Low cashflow

- Interest payments

- Mortgages

- High overhead

- Expensive repairs and maintenance

- Problematic tenants

And the best part?

Digital Leasing allows you to build a passive income stream that’s actually passive!

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000).

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day analyzing deals, cold-calling homeowners, or dealing with contractors.

If that sounds like something you’d be interested in, check out Digital Leasing.

This is the perfect first step to build recurring income that you can then use to start investing in real estate down the line.

However, if you’d still like to know more about Mashvisor, keep reading.

Enter Mashvisor In The Marketplace

Mashvisor was launched in 2014 with the objective of providing investment property analysis to real estate investors.

Their goal is to automate and analyze US real estate market data to help real estate investors discover traditional and Airbnb investment opportunities and improve rental property performance.

Is Mashvisor A Good Tool For A Real Estate Investor?

The fundamental strength of Mashvisor is that it saves a significant amount of time while looking for and assessing residential real estate.

The platform collects and organizes real estate data from various sources (including various MLS sources, Auction.com, Airbnb, HomeAway, companies such as Zillow, Redfin Walk Score, Realtor.com, public record sources, and others) to allow users to quickly crunch the numbers on a large number of properties.

It’s a fantastic tool for assisting investors with valuations, finding some pretty solid rent income numbers in your region, and even locating some relatively accurate costs for each residential real estate you’re considering.

Mashvisor and the resources it provides are also valuable to real estate agents and professional property managers.

Their tool helps property managers find qualified property management leads.

When establishing a property management business, managers must first consider how to generate leads. Most may use conventional marketing methods to attract property management clients.

However, best managers have a lead-generating plan to avoid wasting money and effort on the wrong audience. Instead, they seek customers who may be interested in the services offered.

The Mashboard is the first thing Mashvisor offers for real estate agents and property managers.

What Is Mashvisor Useful For?

Mashvisor has numerous interwoven purposes, however depending on what each particular real estate investor needs assistance with, different elements may be more relevant to unique investors.

Search Function

It will begin by showing all publicly listed investment properties on the MLS, as well as foreclosures, bank-owned homes, and short sales on Auction.com.

Simultaneously, it will do all of the calculations and give you a few important metrics for each property that most real estate investors will be interested in:

- The most recent listing price

- The site location (the locations are also shown on the map)

- The Cash on Cash Return, if utilized as a traditional rental property.

- The Cap Rate, If utilized as a traditional rental property.

- The Cash on Cash Return, if utilized as an Airbnb rental.

- The cap rate, if utilized as an Airbnb rental property.

What is especially helpful is that you can filter all of the rental properties by Cash on Cash Return, Cap Rate, or Asking Price (among other things).

In other words, if you simply want to cut through the clutter and discover which real estate investment properties have the greatest possible return based on these predicted figures, it will filter out all the real estate investment properties you probably won’t be interested in.

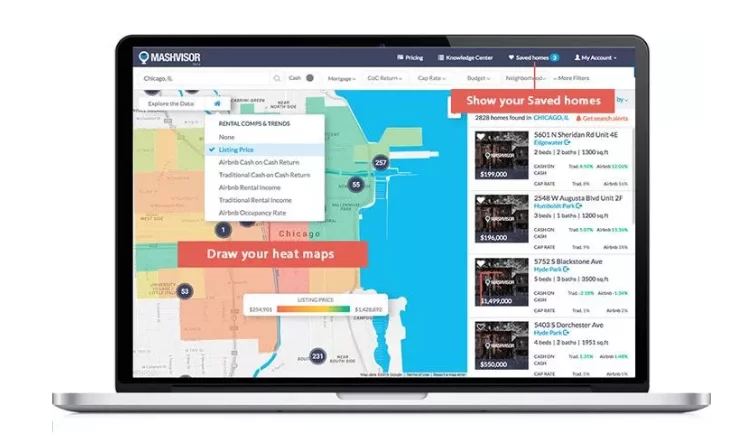

Real Estate Heat Map

A heat map is a real estate market analysis tool that employs visual signals as well as numerical data to differentiate between various places depending on performance.

Mashvisor’s heat map tool uses different colors to indicate different percentages or ranges of critical real estate indicators.

Using a heat map analysis tool to find an area with high-yielding investment homes for sale simplifies and expedites the process.

It eliminates the need to juggle multiple sources and spreadsheets when analyzing investments.

How Does The Heat Map Work?

A heat map works by combining predictive analytics and real estate data.

Using different colors, the heat map depicts how various places perform on average (green, yellow, and red).

The colors indicate if the chosen measure is low (red) or high (green) (green).

Depending on the heat map tool you choose, you may filter your search by a variety of criteria. Using Mashvisor’s heat map tool, real estate investors may discover locations with the lowest listing prices, greatest rental income, cash on cash return, and Airbnb occupancy rate.

Let us examine the heat map tool’s metrics.

Listing Price

The first question on an investor’s mind is usually, “How much would it cost me to buy an investment property?”

The first step in making use of a real estate heat map is to determine affordability.

You will be unable to invest if the area is doing well but your budget is less than the specified values. To utilize Mashvisor’s real estate heat map function, first choose a city, followed by the listing price filter.

With the listing price filter enabled, you’ll concentrate on the red regions on the map. The red hue indicates the cheapest regions.

You may also view the listing price range for the whole market (minimum-maximum). This will give you a general sense of what the colors represent in terms of real estate pricing. It will show you which areas in that city offer investment properties within your budget. If you want to buy inexpensive rental properties, concentrate on the red regions.

Cash On Cash Return

Following the discovery of a cheap location, you may apply another filter to learn more about the region’s investment prospects. You may filter by Airbnb Cash on Cash Return or Traditional Cash on Cash Return using Mashvisor’s heat map feature.

These measures will offer you the average cash on cash return for that region and an optimal rental strategy. Using a real estate heat map to discover cash on cash return may help you decide which rental approach is most profitable.

After deciding on a rental plan, determine a fair cash-on-cash return. Aim for green communities with excellent cash on cash returns.

Remember that the cash on cash return indicates the return on investment of an income property depending on the amount invested.

While you may select a neighborhood with high cash on cash return, you must also analyze the particular income property to see how your unique financing will impact the cash on cash return.

Rental Income

Rental income is essentially an investor’s wage and is vital in real estate ownership.

The real estate heat map may also be used to show the rental revenue generated by each rental plan (Airbnb or Traditional).

You can discover which rental approach has a higher prospective rent in each area by filtering using Airbnb rental income and Traditional rental income.

Airbnb Occupancy Rate

The final filter you may look at using a real estate heat map tool is the average Airbnb occupancy rate for short-term rentals in the area.

When investing in short-term rental properties, like with long-term rental properties, vacancy rates are critical.

Rental Property Calculator

Mashvisor’s rental property calculator provides investors with the real estate data they need to calculate the expected revenues, expenses, and profit from a certain income property.

How Much Does Mashvisor Cost?

For varied investing requirements, the Mashvisor platform provides three Plan Options:

Lite

Individual rental properties should be evaluated. Get an income and ROI analysis based on real rental comps for traditional rental and Airbnb revenue for specific rental properties.

Standard

Find out about investing options. Investigate and determine the most profitable real estate assets, localities, and cities based on your specific cost profile and profit target.

Professional

Conduct large-scale research and client management. As a full-time real estate investor or agent, you will be required to examine large datasets. Use the multifamily and foreclosure criteria in your investment property searches.

Is The Mashvisor Platform A Legitimate Property Finder Tool?

Yes, the Mashvisor platform is a genuine real estate property finding tool.

Building a lucrative, successful real estate company is totally achievable… However, there are better methods to establish a company than via real estate.

Our #1 pick proves this. Because, unlike Mashvisor, it actually provides real proof of real success from real people as recently as a few days ago.

Mashvisor Review: Conclusion

Mashvisor fills a distinct competitive need in the residential real estate industry.

It’s tough to imagine a landlord who wouldn’t profit from Mashvisor. The cost of their services is inexpensive, their present clientele raves about them on review sites, and the potential time savings are huge.

However, when it comes to starting a company, you have several possibilities.

And even if you’re dead set on becoming a real estate investor, you’ve got way better options than Mashvisor.

Keep in mind, we don’t get paid to promote any of the programs we review. We personally think real estate investing is a great business model, but you could end up leaving way too much money on the table.

Is Mashvisor A Scam?

So, is Mashvisor a scam? Not technically. You can make money with this program, but it’s definitely not as easy as gurus makes it sound.

There’s a ton of work to be done upfront, no real guarantee of success, and – most importantly – the actual profit margins on real estate investments are pretty small.

Now, there’s nothing wrong with front-loading the work and making the money later.

But if you’re grinding it out for 3 months – looking at deals, sending out offers, negotiating with the seller and lender to buy a rental property – and then your reward is like $100 a month in profits, it’s not really worth it.

What if, instead, you could do that same 3 months of work (in your spare time), and your reward was a $500 to $2,000 payment that came in every single month (with a 90-95% profit margin)?

And what if you actually didn’t need to wait 3 months? What if you could get started today and have your first payment in a week?

And what if you could double it next week?

Well, that’s the power of Digital Leasing.

And, unlike traditional real estate, you can legitimately do this from anywhere. It’s a true lifestyle business.

Your laptop and an internet connection is all you need.

Some of the most successful students in this program run their entire 6-figure businesses from:

- A camper in the middle of the woods

- A beach chair on the water in Mexico

- A small villa in Greece

They’re able to travel around, living their lives first, and focusing on their income second.

Because even if they stop working for an extended period of time, the money keeps coming in.

So adventure, memories, and experience are the top priority.

And they never have to worry about how to pay for the next trip, or consider asking for time off.

If this sounds more like the type of life you want to lead, just click here to find out more about Digital Leasing.

Are There Alternatives To Mashvisor?

Yes, there are plenty of other business models to choose from if you want to pursue this making money online. Here are just a few:

What Is My Top Recommendation In Making Money Online In 2024?

Our review team has spent months researching, reviewing, and vetting dozens of business models and thousands of programs.

While there may be no “perfect business”, the research IS conclusive:

Digital Leasing is the #1 online business model for those just starting out.

Whether you’ve never made a dollar online, or you’ve been in this space for a while but never really “made it,” Digital Leasing is for you.

Why?

1) It’s Flexible: got an hour a day? You can do this. Ready to drop everything else and dive in full time? You can do this. Yes, the more time you put in, the faster you see results. But even with a little time each day, you can move the needle in a Digital Leasing business.

And because this system is so flexible, you don’t have to constantly be working to make more money. It’s called PASSIVE INCOME because if you stop working, the money doesn’t.

Imagine taking 3 months off to just tour around Europe, rent a cabin in the woods to write a book, hike the Appalachian Trail, or live on the beach and surf all day.

This is only possible if you have an income stream that’s not tied to your time.

Flipping and wholesaling are full-time jobs (and more), no matter what any real estate guru tells you. You always have to be searching for deals, because if you stop, so does the money.

2) You Own & Control EVERYTHING: Yes, in traditional real estate you kind of “own” the properties. But there’s also a ton of debt tied to most real estate investments, which means the property isn’t truly yours.

A lender can take it away if you miss a payment. Not to mention, loan payments really impact your profit margins.

With Digital Leasing, you own the assets outright (with a 90-95% profit margin), which means you have all the power and all the control.

3) Little To No Startup Costs: It’s possible to get into Digital Leasing with zero dollars upfront. Because, using the strategies outlined in this program, you can get a client to pay you BEFORE spending a penny out of your own pocket…even before you do any work.

Even without getting paid in advance, you can have your first Digital Rental Property up, running, and generating profits for less than $100.

4) Minimal Ongoing Expenses: With traditional real estate, monthly expenses are HIGH. Between loan payments, ongoing maintenance, and repairs (not to mention the possibility of having to go through the eviction process), profit margins are slim.

Plus, whenever you have a vacancy, factor in the costs to turn over a unit (plus the fact there’s no money coming in until the next tenant moves in).

With Digital Leasing, a 100% online business with minimal maintenance and ongoing costs, you never even have to think about that risk.

5) Easy To Duplicate: Ok, here’s the best part: once you have your first Digital Rental Property up and running, you can literally DOUBLE your income with a few clicks, a couple keystrokes, and a single phone call (and you don’t actually need the phone call).

Remember: each Digital Rental Property is worth $500 to $2,000 a month in semi-passive income (over 95% profit). Every time you decide to create another one and increase your income, it gets easier.

Because you have more knowledge, more experience, more results, and more momentum.

If you wanted to double your income with traditional real estate investing, you’d have to double your monthly rent, double your deals/number of units OR double your profit margins. And, guaranteed that’s a lot harder than a few clicks and a few minutes of your life.

6) Make Money Helping Real People: This part is what makes it all worth it. With Digital Leasing, you’re actually helping people by solving your clients’ biggest problem:

Small, local businesses need more customers, and with Digital Leasing, you are unleashing a flood of happy, paying customers for these businesses.

You make money by helping them make money.

Not a big, faceless corporation either…a small business owner who’s using that money to put food on the table for their family, start a college fund for their kids, or take care of a sick parent.

Once you see how Digital Leasing makes a real impact in the lives of real people, you’ll sleep like a baby with a big smile on your face.

Now, the choice is yours. You could continue browsing, looking at opportunities like Mashvisorwhich could one day make you money.

You could continue researching, never making a decision.

OR, you could take a look inside, consider what you really want, and join a program that makes your dreams a reality. At the same time, joining a community of over 2,000 successful students that are living life on their own terms thanks to Digital Leasing.

A consistent, reliable, semi-passive stream of income that doesn’t depend on you or your time to keep producing profits.

All while genuinely helping real people who are grateful and happy to pay for it.

If this sounds more like what you want out of life (or if you just want some nice side income), click here to learn more about Digital Leasing.