Fundwise Capital At A Glance

Fundwise Capital is a Utah-based financial services company. They do not, however, lend startup funding and capital. Rather than that, they have a staff of people who work 24/7 to link customers with third-party lenders.

In some ways, they’re similar to a high-end middle man.

Wait…

Therefore, how do they generate revenue if they are not lenders?

Excellent question!

But, before we go any further, I want to be totally up front here, so…

Fundwise Capital earns money through its clients, partners, and credit counseling program fees.

You probably discovered Fundwise for the same reason you might have come across any other financial newsletter, trading service, or investment program:

Because you want more money in less time.

And chances are, you want to quickly multiply the money you do have (as opposed to waiting months or even years to see a decent ROI).

This is a really exciting promise, and it’s probably why the financial publishing and training industry is worth billions of dollars.

The problem is, because the idea of doubling, tripling, or 10X-ing your money in a few minutes to a few days is so enticing, there are a ton of shady characters in this space.

But, putting that aside, let’s say every investing guru and “trading expert” on the internet had the best of intentions.

Even with proprietary algorithms, a room full of supercomputers, and a team of rocket scientists, most of these experts would be lucky to get it right 20% of the time.

Now sure, we’re talking about asymmetric bets here, so theoretically the winners should more than make up for the losers.

But in order to make that happen, you can NEVER miss a trade. With a 20% success rate (speaking optimistically), one missed winner could turn a profitable month into a loser.

That’s a lot of pressure and a lot of stress (not to mention a lot of losing) with not much certainty.

But what if there was a way you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Constantly monitoring your phone for buy/sell alerts

- Obsessively watching charts and movement

- The emotional roller coaster and angst of hoping one winner can cover the last 8 losses

- Gambler’s odds (20% chance of success is worse than the odds of winning at Blackjack)

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day monitoring charts, trades, and alerts?

If that sounds like something you’d be interested in, check out Digital Leasing.

However, if you’d still like to know more about Fundwise, keep reading.

Is Fundwise Capital Worth It?

That depends…how adept are you at locating various loan companies? Fundwise is for you if you already have an excellent credit score, a limited amount of time, and few connections. Fundwise Capital summarizes all of the company financing choices available to you in one place!

WARNING: We would suggest you proceed with caution in the area of alternative funding. Interest rates can be high, and if you are unprepared or unfortunate, the consequences can be severe. We strongly advise you to seek alternative sources of finance and funding options before taking out loans.

Learn About A Business Model That Will Never Require Loans Again!

Who Is Fundwise Capital For?

Entrepreneurs, small business owners, real estate investors, start-ups, and everyone. They have relationships with various lenders and capital funding companies, enabling you to realize your ambitions!

Whether you are a first-time business owner or a seasoned real estate expert like Grant Cardone, we strongly advise you to investigate Fundwise Capital cost and what they have to offer.

After all, they are virtually always able to connect you with those who can provide the cash you require.

What Services Does Fundwise Capital Offer?

Business Credit Cards: A company credit card is similar to a personal credit card in many ways… however, there are particular regulatory distinctions. It’s worth mentioning that corporate credit cards typically have bigger credit limits and better rewards schemes!

Installment Loans: This is most likely the simplest of the three. Installment loans are loans in which the lender pays you with a lump sum, and you repay the loan by making interest-bearing payments according to an agreed-upon schedule.

Lines Of Credit (Build Business Credit & Personal Credit): A line of credit is established for you or your business, and you can borrow up to the line’s limit. Generally, you are only required to pay the interest on the amount borrowed.

What Do I Need To Qualify?

Fundwise requires the following borrower qualifications:

Revenue: N/A*

Credit Score: 680

*Your income is taken into account.

Terms & Fees Rating:

Fundwise capital makes acquiring capital simple for its customers. They have a 5/5 rating from us.

Lines Of Credit

What to expect from a Fundwise Capital line of credit:

Credit Limit: $25,000 to $300,000

Term Length: 6 to 18 months

Interest Rate: 0% for 9 to 15 months, 1%-2%/month after

Other Fees: $500 + 9% approval fee

APR: 0% for 12 months

Collateral: N/A

Fundwise Capital lines of credit are available to individuals and businesses alike. However, to qualify for business lines of credit, your business must have a verifiable history of existence. Otherwise, you will be compensated based on your income.

This might be aggravating for first-time business owners.

Personal and business lines of credit are agreements between a lender and a business owner under which the business owner can borrow money up to the credit limit agreed. There is no one-time payment.

Additionally, you are only responsible for repaying the money you borrowed. Fundwise Capital can connect you with various lenders who provide both revolving and non-revolving credit lines.

Revolving lines of credit are the same as credit cards in that the more you pay your balance, the more available credit you have.

Additionally, Fundwise Capital‘s lines of credit come with additional benefits compared to those offered by other organizations. For starters, they offer a year of 0% interest! This is an excellent alternative for new entrepreneurs and real estate investors!

Installment Loans

Fundwise can connect you with installment loans, albeit Fundwise capital does not provide as much information about terms as we would want.

Borrowing Amount: $25,000-$300,000

Term Length: 3-7 years

Interest Rate: 0%-15% on first 9-15 months

Other Fees: $500 + 9% approval fee

APR: 6%-23%

Collateral: N/A

Installment loans, credit or term loan, medium-term loans, and long-term loans are the most common loan forms. Often, these loans are several years in duration, accrue interest, and are repaid monthly.

The advantage of Fundwise Capital is that they negotiate lower interest rates on behalf of their clients! This means that you could receive 0 percent interest for up to two years at the most!

If you have an excellent credit rating…

This could be an excellent way to obtain business money, mainly because they handle all of the paperwork associated with the funding procedure for you!

As with the personal and company lines of credit mentioned above, these loans are unsecured lines, which means they do not require collateral.

Business Credit Cards

Fundwise Capital can assist you, and your small or large firm obtain a business credit card.

While credit cards are not the most suitable way to finance a business early on due to the balance transfer fee becoming more expensive than most loans, they can be a good option for individuals who can pay things off promptly. most suitable

However, how quick is quickly?

Business credit cards include a grace period of 21 days, and if you pay off your business credit card during that time period, you will not be charged any business financing fees, yep, no interest.

Perhaps the nicest feature of a business credit card is the ability to earn points and save money through the card’s rewards program!

Important: A corporate credit card will charge 15% and 25% annual fees. However, most firms, particularly those supplied through Fundwise Capital, waive the first year with no interest APR on balance transfers and purchases.

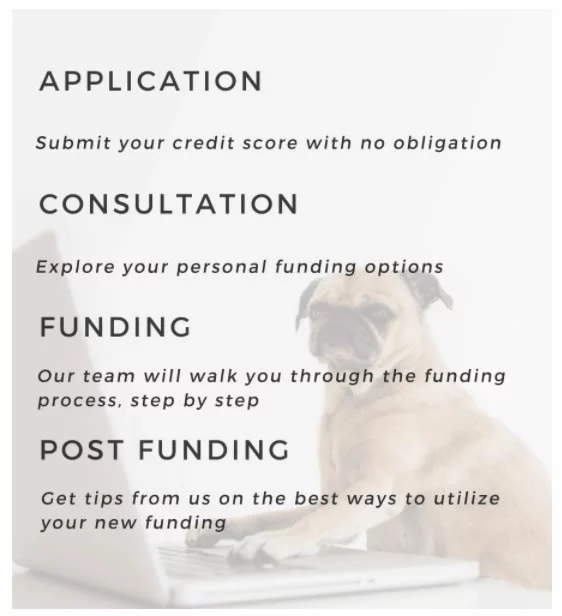

What Is The Application Process Like For Fundwise?

Rating: 4/5

Fundwise Capital‘s application procedure starts online at fundwisecapital.com. Your credit rating will be relevant depending on the financial product you seek. However, the weight placed on your credit history during the approval process will differ depending on the type of company financing you desire. Credit rating is critical for Fundwise capital.

Fundwise demands you open a credit monitoring account and request to view the credit monitoring results to obtain funds. While that may seem weird, it saves you from having to perform a hard pull on your credit!

Fundwise capital may require proof of income, in addition to the credit monitoring account,

According to Fundwise capital, you may expect to receive funding between ten to twenty-one days. The funding process is a little slow for an online loan provider.

The application process for lines of credit, loans, personal credit cards, and business credit cards is often straightforward. From the initial phone call, Fundwise Capital is professional in ensuring that their alternatives are suitable for you!

Transparency Rating: 3/5

Although Fundwise Capital provides a unique service, its website does not advertise. Additionally, they demonstrate numerous “best case best-case” following funding, which may irritate a prospective consumer.

If there is a thing we could suggest for Fundwise Capital’s website, it would probably include more information…

Credit limit and credit card portions, in particular.

Fundwise provides sufficient information for prospective clients to gain a reasonable understanding of the services supplied, ensuring that they will not have too many queries about how to secure finance.

Customer Service, Technical Support, And Facebook!

Fundwise can be contacted in a variety of ways. They can be reached by their website, phone, or email and on all major social media platforms including Instagram, Twitter, Facebook, YouTube, and LinkedIn.

You may be confident that any inquiries you may have will be addressed or located using one of these platforms!

While this is not technically assistance, they provide a consumer the option of using their credit counseling service if the credit monitoring account, credit reports, or first credit report were not satisfactory for business funding.

Do We Recommend Fundwise?

After conducting an extensive study on everything Fundwise, we can confidently suggest them if you have exhausted all other business financing choices.

Many of their clients have positive things to say about them, as seen by customers and other Fundwise Capital reviews! We discovered that the most frequently expressed issue was the absence of advertising and information, as noted previously.

However, another frequent gripe was about the high credit requirements. This is significant because if business owners have excellent credit, they may be able to obtain a low-cost SBA loan.

Having said that, qualifying for an SBA loan may take a little longer, especially with the pandemic and everyone in need.

Therefore, while an SBA loan may make more sense for a business with a favorable credit report, credit profile, and credit score…

It may just be a more sensible choice to use Fundwise rather than the SBA, which is now backed up.

Is Fundwise A Scam?

So, is Fundwise a scam? Not technically. You can make money with it, but it’s definitely not as easy as Fundwise makes it sound.

Again, with any kind of financial product (especially trading), you’re taking on a lot of risk.

Sure, you could hit it big and retire in Italy, but chances are you need the stomach and financial cushion to weather tons of losses before you get there…and it may never happen.

Most of the big gains numbers these companies use in their marketing (“xyz grew by 4,112% in 3 months” or “this option made 324% in just 2 days”) are cherry-picked.

They don’t tell you about the 10 100% losers that came before.

In other words, if you invested $100 into 11 recommendations, you’d lose $1,000, and make back $324…so you’d still be out almost $700.

Most people don’t have the fortitude to stick it out through 3 straight months of losers in the hopes of landing one big winner.

What if, instead, you took those same 3 months, invested just a couple hours a day (in your spare time), and your reward was a $500 to $2,000 payment that came in every single month?

And what if you actually didn’t need to wait 3 months? What if you could get started today and have your first payment in a week?

And what if you could double it next week?

Well, that’s the power of Digital Leasing.

It’s a true lifestyle business.

Your laptop and an internet connection is all you need.

Some of the most successful students in this program run their entire 6-figure businesses from:

- A camper in the middle of the woods

- A beach chair on the water in Mexico

- A small villa in Greece

They’re able to travel around, living their lives first, and focusing on their income second.

Because even if they stop working for an extended period of time, the money keeps coming in.

So adventure, memories, and experience are the top priority.

And they never have to worry about how to pay for the next trip, or consider asking for time off.

If this sounds more like the type of life you want to lead, just click here to find out more about Digital Leasing.

The Best Option Compared To Fundwise!

Our review team has spent months researching, reviewing, and vetting dozens of business models and thousands of programs.

While there may be no “perfect business”, the research IS conclusive:

Digital Leasing is the #1 online business model for those just starting out.

Whether you’ve never made a dollar online, or you’ve been in this space for a while but never really “made it,” Digital Leasing is for you.

Why?

1. It’s Flexible: got an hour a day? You can do this. Ready to drop everything else and dive in full time? You can do this. Yes, the more time you put in, the faster you see results. But even with a little time each day, you can move the needle in a Digital Leasing business.

And because this system is so flexible, you don’t have to constantly be working to make more money. It’s called PASSIVE INCOME because if you stop working, the money doesn’t.

Imagine taking 3 months off to just tour around Europe, rent a cabin in the woods to write a book, hike the Appalachian Trail, or live on the beach and surf all day.

This is only possible if you have an income stream that’s not tied to your time.

2. You Own & Control EVERYTHING: With anything in the financial markets, you own and control NOTHING. You have no say in price fluctuations, demand, or what the market will do.

Trying to beat the market is fighting against the tide. There’s just too much working against you, no matter how many supercomputers or rocket scientists are on your side.

With Digital Leasing, you own the assets, which means you have all the power and all the control.

3. Little To No Startup Costs: It’s possible to get into Digital Leasing with zero dollars upfront. Because, using the strategies outlined in this program, you can get a client to pay you BEFORE spending a penny out of your own pocket…even before you do any work.

Even without getting paid in advance, you can have your first Digital Rental Property up, running, and generating profits for less than $100.

1. Easy To Duplicate: Ok, here’s the best part: once you have your first Digital Rental Property up and running, you can literally DOUBLE your income with a few clicks, a couple keystrokes, and a single phone call (and you don’t actually need the phone call).

Remember: each Digital Rental Property is worth $500 to $2,000 a month in semi-passive income (over 95% profit). Every time you decide to create another one and increase your income, it gets easier.

Because you have more knowledge, more experience, more results, and more momentum.

If you wanted to double your income with any kind of trading or investing, you’d have to double your initial capital OR double the average order size of your existing trades. And, guaranteed that’s a lot harder than a few clicks and a few minutes of your life.

2. Make Money Helping Real People: This part is what makes it all worth it. In the financial markets, you might be helping your family, but the impact never goes beyond you and maybe a few others.

But with Digital Leasing, you’re actually helping people by solving your clients’ biggest problem:

Small, local businesses need more customers, and with Digital Leasing, you are unleashing a flood of happy, paying customers for these businesses.

You make money by helping them make money.

Not a big, faceless corporation either…a small business owner who’s using that money to put food on the table for their family, start a college fund for their kids, or take care of a sick parent.

Once you see how Digital Leasing makes a real impact in the lives of real people, you’ll sleep like a baby with a big smile on your face.

Now, the choice is yours. You could continue browsing, looking at opportunities like Fundwise which could one day make you money.

You could continue researching, never making a decision.

OR, you could take a look inside, consider what you really want, and join a program that makes your dreams a reality. At the same time, joining a community of over 2,000 successful students that are living life on their own terms thanks to Digital Leasing.

A consistent, reliable, semi-passive stream of income that doesn’t depend on you or your time to keep producing profits.

All while genuinely helping real people who are grateful and happy to pay for it.

If this sounds more like what you want out of life (or if you just want some nice side income), click here to learn more about Digital Leasing.