Top Ways To Double $10K Quickly In 2021

So your granny Matilda just gave you a $10,000 check.

Maybe you’re not as lucky, but you’re working hard to save money for your future.

So what are you going to do about it now?

Maybe start your own business or invest it somewhere else.

You’ve probably come at this page because you have a huge sum in your bank account and have no idea how to grow it.

You may also be wondering what the best business model for 2022 is.

Check out our #1 Recommendation For Making Money Online!

When it comes to investing, two things usually come into play: speed and risk.

You’ll learn about how these two factors affect your investment in various ways below.

More stars indicate that ROI may be multiplied faster however more “risk” stars clearly indicate a greater risk.

Chapter 1: The Funding Index

How To Make Money By Doing What The Experts Do!

Speed: 2/ 5 stars

Risk: 3/ 5 stars

Index funds have the potential to generate a massive ROI, which could be used to double your $10,000.

We gave it two stars for speed because it will take you a while to turn $10,000 into $20,000.

Furthermore, the risk is significantly higher than usual if you leave your money to the overall market and system structure.

If you want to use this method, you can take the steps listed below.

Step 1. Keep Tabs Your Accounts.

Before investing in index funds, you must first authenticate your 401(k), IRA, or brokerage account.

A brokerage account allows investors to invest in the stock market. They could make cash deposits before buying assets.

Step 2. How To Pick The Right Fund.

Choose the index in which you want to invest.

Index funds can track a particular asset, company, or industry.

Whichever fund you choose to invest in, make sure it fits your total risk tolerance and adds your other assets.

Step 3. What Is The Least You Should Invest?

Look for the lowest possible investment.

Not all index funds are cheap; most demand a minimum investment to participate.

If you can’t afford the bare minimum, you can remove this choice off your list for the time being.

Step 4. Strive For The 1%.

The time it takes to get your return will be shorter if you use the lowest viable expenditure rate.

If you have to spend more money, the time it takes for your money to grow may be longer.

Step 5. Automatic Funding.

To start, your account must be funded. Next, setup your account to receive donations automatically.

Chapter 2: Rent Or Flip

Real Estate Tycoon Simulator IRL

Speed: 2/ 5 stars

Risk: 2.5/ 5 stars

If you enjoy watching HGTV or imagining yourself as Chip and Jo, this one is for you!

Obviously, $10,000 would not be enough to flip and rent a house on your own, but this could be a great choice for a joint effort.

1. Create A Roadmap.

Create a strategy and determine your goals. Your end goal should be based on your financial capacity, investing plan, and objectives.

2. Your Network Is Your Net Worth.

Gather as much information as you can from other local landlords/investors and communicate with them.

However, you should also take into account their investment bias. The landlord’s buying approach, experiences, and end goals all contribute to his or her bias.

This can help you find other investors/landlords who have similar goals but significantly more resources than you.

They can provide you advice and handle your concerns.

3. Figure Out A Down Payment

Start putting money aside for a down payment.

When you start looking for a property, make a budget for it.

Set aside at least 20-30% of the purchase price for a down payment, and schedule a consultation with your bank to discuss options based on your budget.

4. List Your Expenses.

Analyze your expenses.

Each rental property has expenses; it is important that you fully understand how this works – the monthly and any unexpected costs – if you are to be successful with this strategy.

5. Location, Location, Location.

You would also need to do your research when looking for a growing real estate market. The following are some questions to consider when doing your homework:

- Is the property in a good neighborhood?

- Is it close to any businesses or attractions?

- What is the property’s walk score?

- How many other people live in the area?

- What is the crime rate in the area?

- What is the average household income in your neighborhood?

6. Inspect What You Expect.

Spend money on a proper home inspection.

Although house inspections might cost between $250 and $450 or more, they will benefit you in the long term.

It may show issues that, if overlooked, might cost you a fortune.

Please keep in mind that the results of the inspection may be used in the negotiation phase of your property purchase.

7. Pro Forma

A pro forma is just an estimate of the property’s cash flow.

These forecasts help in determining the property’s projected monthly cash flow, including taxes and estimated ROI.

8. Appraisal

Make sure you get an appraisal.

When you want to finance a rental property purchase, the lender will order a property appraisal.

This allows both parties to confirm that the price paid for a property is correct and not overpriced.

9. Research Insurance Options.

A good insurance policy will protect your new investment property from unnecessary risk.

Look for local agents and talk about your options, cost, and coverage with them.

As a property owner, umbrella insurance policies may be beneficial in the long run.

These provide you with an additional layer of protection in the event of an unforeseeable accident or lawsuit.

These are intended to protect your property and other financial assets.

10. Make An Offer.

When you find a property you want to invest in, contact your real estate agent, who will complete the required documents and present your offer.

Don’t let your emotions get the best of you, and only invest what you can afford.

Since the timeframe for you to close varies, it is advisable to act fast.

It’s also a good idea to make sure the transaction is finished before the deadline.

Start working on the terms and agreements if you’ve decided to hire a property manager.

Your ROI rate is determined by how quickly you can rent out the property.

Chapter 3: Stocks

The Backbone Of Wall Street

Speed: 4/ 5 stars

Risk: 4/ 5 stars

A few examples are NASDAQ, New York Stock Exchange, EuroNext, TMX Group, London Stock Exchange, and Australian Securities Exchange.

What is their common denominator?

All of them are based on stocks.

Stocks are essential since they are one of our modern global economy pillars.

Let’s start.

1. Assess Your Financial Situation.

Before you invest in stocks or bonds, make sure your financial condition can take it.

There are several critical factors to consider in order to determine this:

- Check to see if your income and work are both stable enough for you to invest.

- If you have previous financial obligations, you should obviously prioritize paying them off before investing. Never put money into an investment that you cannot afford to lose.

- If you have a child, you may need to commit all of your available funds to that child’s care.

- You should have enough money in your household budget to invest.

2. Pick A Lane.

Make a decision on how you want to invest in stocks.

Are you looking for a more hands-on or a more hands-off approach?

Both are viable options, but the hands-off technique is better for most people.

Consider getting a Robo-adviser.

3. Open An Investment Account.

You must first open an investment account before you may invest in stocks.

Depending on your level of participation, this may include opening a brokerage account or an account with a Robo-advisor.

Also, keep in mind that 401(k)s are a type of investment account that includes mutual funds, so you may already be investing in that through the 401(k).

4. Set A Budget.

Consider the following while budgeting:

- How much money do I need to start investing in stocks? Both are viable options, but the hands-off technique is better for most people.

- How much money should I invest in stocks?

5. Invest Gradually.

Gradually increase your investment. Individual stocks should make up no more than 10% of your total investment.

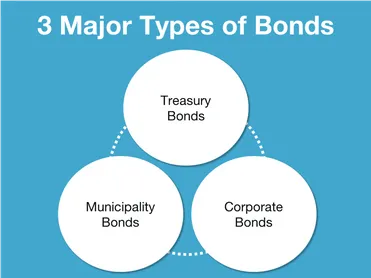

Chapter 4: The Name Is Bonds.

Standard Bonds

Speed: 1/ 5 stars

Risk: 0.5/ 5 stars

Bonds are another crucial element of today’s global economy.

Bonds are less risky than stocks because they take longer to mature.

This is why we only gave it one star for speed and a half-star for risk.

Here are some tips for investing in bonds:

1. Understand The Basics.

Learn the ins and outs of bond investment.

When you buy bonds, you agree to lend a certain amount of money to the issuer for a specific amount of time.

In exchange, the issuer agrees to provide fixed-rate monthly interest payments until the bond matures, at which point your principal is fully returned.

2. Start A Brokerage Account.

Bonds can be purchased through a brokerage agency that works with governments and corporations who want to issue debt.

Brokerage companies can also have access to secondary markets where bonds can be purchased.

3. Which Type Of Bond?

Pick the type of bond you want to buy. Bonds come in different types, like coupon bonds and treasury bonds, to mention a few.

4. Evaluate The Bond(S).

It is very important to examine bonds before investing in them.

Examine the issuer of the bond because their reliability differs.

The great majority of issuers will most likely fall into one of these categories:

- The US Treasury is often recognized as the gold standard of dependability.

- Other US Government Agencies might have slightly higher yields than Treasury Bonds, but the risk is considered lower.

- Municipal government bonds bear a little higher risk than federal government bonds.

- Foreign governments will be either low risk or high risk, with corresponding low or high returns. The country issuing the bonds has complete control over this.

5. Bond Grading

Another method for assessing bonds is to look at their grade.

Bonds are graded according to their credit rating and the issuer’s capacity to repay the investment.

Bonds with ratings around AAA-C and AAA are considered better, and those with ratings closer to AAA are considered the best bonds.

On the other hand, any bond with a BBB or higher is considered investment grade.

6. Bond Laddering

Another option is to invest in bonds using a laddered technique.

It is necessary to purchase bonds with staggered maturing rates due to the variable rates of maturity.

It’s worth noting that when you buy bonds, you’re committing to a specific interest rate for a set period of time, so if their maturities are staggered, you’ll have greater liquidity.

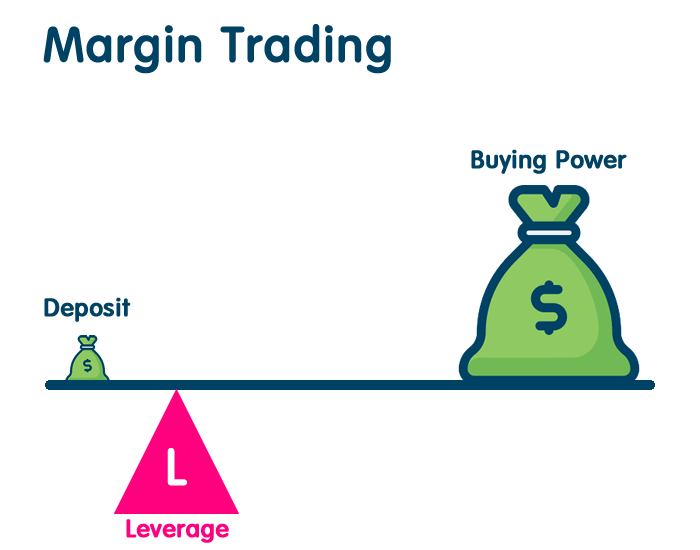

Chapter 5: Margin Trading

Borrowed Money Making Money

Speed: 4/ 5 stars

Risk: 4.5/ 5 stars

The margin is the amount of money borrowed for investment purposes.

Here’s a breakdown of important margin information:

Because you are using someone else’s money to make money, it is very risky, but highly profitable.

You have an greater chance of doubling any investment you pair with a loan if you use this approach.

Before you start margin trading, you should be aware of the following criteria:

1. Open Up A Margin Account.

A margin account is a special account set up with a broker to start margin trading.

They are often subject to minimum account balances, which are frequently determined by the loan-to-value ratio of the account.

2. Buy.

Begin purchasing stocks using borrowed funds.

The sole purpose of margin trading is to purchase equities with borrowed funds.

Earnings can be significantly increased when compared to spot trading by using borrowed funds to purchase stocks.

3. Hold.

Hold the position for a short period of time.

Choose one or two month time frames for margin purchases to avoid unexpected price reductions or market corrections.

4. Sell.

Sell the stock when it reaches a certain level.

Don’t be greedy; instead, set a price target ahead of time.

If your price target is not met, reconsider your options and consider selling.

Chapter 6: Land Flipping

Dirt Never Looked So Good

Speed: 3/5 stars

Risk: 3/ 5 stars

Most people believe that flipping houses is the easiest way to make a lot of money in real estate, but this is usually because people overlook the land.

Flipping land can provide a similarly enticing return without the large expenditure of upgrading and modernizing a home.

We gave three stars to the speed of doubling the investment and the possible risk, which is higher on average, as with any major asset purchase.

However, you can reduce your risk and achieve your financial goals more quickly by taking the proper precautions.

1. Market Research

If you’re thinking about real estate investment, it’s a good idea to look at a few different markets.

Most markets offer a wide selection of options, however the price range and property type vary.

Here are a few market research tips:

- Decide on your ideal property to the best of your ability.

- Make a budget for both marketing and real estate purchases.

- Know the state and municipal regulations that govern the selling of vacant land.

- Decide whether you want to sell for cash, with seller financing, or both.

2. Direct Mail Marketing

Direct mail marketing is usually identified as the most efficient and cost-effective technique of finding great deals.

The ability to find and organize the right data, as well as convey appealing messages to the right people, decides whether a direct mail marketing campaign is successful or not.

Decide if you will get your list of property owners via a data service or from the county.

For the best response rate, create a sorted and filtered list.

You can simplify the procedure by using a direct mail service provider, such as Vistaprint, Mail Shark, or Every Door Direct Mailer.

3. Process Leads And Make Offers.

Set up the systems you’ll need to handle your direct mail campaign.

Install and run a phone system with an unique voicemail recording to handle calls from sellers.

Create a purchase website where prospective sellers can send you property information online.

When responding to leads, make sure you get all of the information you need to close the deal.

Create a system for nonbinding offers.

Sending out blind offers with your direct mail marketing is one way to do this.

If you must haggle, do so only on properties that are worth it, and always make sure that the price is well within your budget.

4. Proper Due Diligence

You must begin conducting due diligence as soon as your proposals are approved.

To be confident in your investment, you must conduct your own research.

Make a point to gather all relevant information and double-check that everything is correct.

Look for other similar properties for sale in the neighborhood to assess the property’s market value.

5. Close On The Acquisition.

You have two options for closing: through a real estate attorney/title company or on your own.

For properties under $5,000, you may conduct your own title search to:

- Carry out an in-house cash closing.

- Make sure that there is a clear chain of title.

For homes cost more than $10,000, you can sign your purchase agreement and submit it to a qualified closing agent, who will handle the rest.

Use a hybrid strategy for properties priced between $5,000 and $10,000, purchasing title insurance and closing the deal yourself.

6. Make It Shine.

Most properties would need some work to make them look better.

It could be anything from raking leaves to a major renovation, depending on what needs to be done.

Others, such as the removal of a stump, weeds, or unattractive vegetation, or the placement of correct markers for a future driveway, may require land clearance.

The goal is to persuade potential buyers of the worth of your property.

7. List, Sell, And Promote.

After you’ve purchased several properties, the next step is to sell them!

Some properties sell quickly, while others do not.

The speed with which the transaction takes place is greatly influenced by the quality of the listing as well as its location.

Begin by creating an attractive property listing.

A successful listing requires high-quality images, a detailed narrative, and, if possible, a video.

Post your property listing in as many places as possible to promote it.

Focus on sites with the most traffic and targeted audience.

Set a competitive price for the property.

If possible, provide seller financing.

8. Process Buyer Leads.

Concentrate your efforts on sites that have the most traffic and your target audience.

Set a reasonable asking price for your property.

It’s also a good idea to provide seller financing if it’s available.

Respond to every comments, calls, test, and emails.

It is crucial to follow up on everyone because it is tough to identify whether or not someone is a serious buyer.

9. Close The Sale.

The complexity of the closing process varies depending on the following factors:

- Property

- Buyer

- State regulations that apply

- Whether sold for terms or cash

When you have a buyer who is interested and has verbally committed to you, you must set a closing date right away.

Depending on the transaction’s profit margin, you may need to hire a title company for the paperwork and closing.

However, if the profit margin is too low, it can be done in-house.

Simply have the buyer sign the deed once you’ve received payment.

Chapter 7: Home Renovation

The Long, Long Game

Speed: 1/ 5 stars

Risk: 0.5/ 5 stars

If you own a property and plan to sell it in the future, there is no better way to increase your potential ROI than to update or remodel it.

This investment has the ability to significantly increase your selling price or to improve your quality of life while you live there.

We gave this strategy one star for speed and a half star for risk because selling may be a long way off.

Improvements That Give The Best ROI

In reality, your house may be your most important investment.

If any parts of your house are old or in need of replacement or repair, some of those improvements may have a direct impact on the value of your property.

The following are some house renovations that will readily increase the value of your home:

- Replace your home’s siding.

- Replace your old roof.

- Replace the windows.

Minor changes to your bathroom or kitchen, such as replacing worktops with granite, can make a big difference.

It is important to note that you do not need to spend a lot of money to see a significant increase in your property value.

Chapter 8: Online Savings Account

ROI In A Lifetime

Speed: 0/5 stars

Risk: 0/ 5 stars

The most popular strategy is to save money online, to the point where there would be no return if it weren’t for the higher interest rates offered by online accounts.

It’s mainly due to the fact that the speed shows that this isn’t a good investment.

We gave it zero marks for speed because attaining a double ROI would take longer.

We gave it 0 stars for risk because it is one of the safest ways to invest.

2-Step Savings Method

- Explore your options. Interest rates on online savings accounts may be higher than those offered by your local bank. Check with the FDIC to see if the bank is FDIC-insured. Read the fine print on withdrawals carefully; you don’t want your money to be inaccessible when you need it.

- Start depositing funds into your preferred account.

- Investing in a CIT bank is a great way to start a savings account. Interest will be charged at a rate of 0.40 percent.

Chapter 9: Invest In A CD

Singing Not Required

Speed: 1/ 5 stars

Risk: 1/ 5 star

One of the most secure investments offered today is a certificate of deposit (CD).

Your investment receives a small percentage of its maturity value over a specified timeframe.

We scored it one (1) for speed to ROI and risk due to the following approach.

1. Find The Right Institution.

The FDIC and the NCUA insure banks and credit unions, respectively.

If an insured institution holds your CD, you will be covered to the full extent permitted by law by insurance.

2. Pick The Right Term.

You must decide how long you want your money to be locked up when you open a CD.

If you want to earn a greater interest rate, you must plan for a longer term length.

3. Choose Your Type.

There are various types of CDs; they are not one-size-fits-all. Determine which one works best for you. To mention a few, there are traditional CDs, bump up CDs, liquid CDs, and zero-coupon CDs.

4. Review Rates.

Once you’ve decided on the type and term length of your CD, you should compare the rates given by multiple banks.

5. Options For Collecting Payments

Set a date for when you want to get your interest payments.

You have various options for collecting your interest payments.

You could collect on a monthly or annual basis.

Your initial investment, as well as your last interest payment, will be refunded to you at the end of your term.

6. Consider Laddering.

While CD investing has some downsides, one way to reduce them is to use a strategy known as laddering.

Laddering is a means of gaining regular access to your money while also protecting you from rising interest rates.

Laddering is much simpler than you think.

Instead of investing all of your money in a single CD, divide it into equal parts and invest each in a CD with a varied term.

Laddering has the following benefits:

- You can withdraw your funds without penalty when a CD matures.

- You will have access to higher interest rates because a portion of your money will be invested in a long-term CD.

- If you chose to reinvest, you may get better returns if interest rates are higher..

7. Fund The CD.

Choose the most appropriate financing strategy or source for you.

You can transfer funds online, over the phone, or by mailing a check.

Chapter 10: Mutual Funds

How To Make Money With All Your Friends

Speed: 1/ 5 stars

Risk: 1-2/ 5 stars

If you are a newbie, one of the best options is investing in mutual funds.

We gave one star to potential return speed and a variable one to two for risk.

1. Go With The Grain Or Against It.

Choose between a passively managed and an actively managed mutual fund.

Determine whether you want to outperform or replicate the market when deciding.

2. Calculate Your Budget.

It’s worth noting that the general rule is to feel confident leaving your money alone for at least five years.

Here are a few more questions to help you figure out your budget:

- How much money do I need to start? There is normally a minimum deposit to open an account and start investing. Brokers, however, have no required minimum. Others range from $500-$3,000.

- What do I do with that money? What is your ideal fund mix? Age has a big role here. You value investments that preserve capital over earnings if you are nearing retirement. On the other hand, younger investors have more time to take risks.

3. Research Fun For The Mutual Fund.

Just like stocks, you’ll need a brokerage account. Investing in mutual funds offers various options.

Likely, you’ve started mutual fund investing in your 401(k).

Another option is to buy directly from the fund’s creator, such as BlackRock Funds or Vanguard.

Many investors choose the third option, buying through an online brokerage.

Buying through an online brokerage gives you access to a wide range of mutual funds from various companies.

If you choose an online broker, bear in mind:

- Affordability

- Fund options

- Research and educational tools

- Accessibility

4. Minimize Your Fees.

It’s always a good idea to keep fund charges and fees to a minimum because they can eat into your returns if you don’t.

In general, expense ratios should be less than 1%.

5. Pick A Diversified Portfolio.

It is important to diversify your investments.

There is no diversification if you have five separate funds that are all the same investment.

It’s the same as if you were the sole owner of a larger fund.

You want your money to be invested in equities, bonds, real estate, etc. Another way to keep your portfolio diverse is to rebalance it once a year.

For example, suppose one of your assets produced huge profits and now accounts for a larger portion of the pie. In that case, you may consider selling some of the gains and reinvesting the proceeds in another area to restore the balance.

6. Find A Family Of Funds.

Look for a company that offers a family of funds that meets your needs.

The simplest way to open an account is to go directly to the fund firm that offers shares.

If you can find a company that can provide income for your family, it will make your life a lot easier.

7. Invest And Monitor.

Consider investing in a mutual fund.

After that, the fund should be monitored to guarantee that it is balanced.

Your work does not end once you have picked a fund and invested in it.

You must continue to check it to ensure that everything is working well.

It should be noted that past performance is not a guarantee of future success.

Final Words

Depending on your preferences and circumstances, all of the methods discussed above are great ways to double your money.

However, while these are all excellent ideas, you should consider putting some of them aside in an emergency fund.

If you have an emergency fund, you can avoid liquidating investment accounts to handle the situation. When that account is secured, $10k is more than enough to get your feet wet in the financial world.

Keep the following points in mind before you invest:

- Have you opened retirement accounts? If so, do you make maximum contributions?

- How much credit card debt do you have, if any? How about student loan?

- Do you understand what mutual funds, robo advisors, and stocks are?

- Do you want to try something out of the ordinary?

Lastly, no one can help you better than a qualified financial planner if you are new to investing. Believe me, it will go a long way.

What Is Our Top Recommendation For Making Money In 2024?

Our review team has come across a program in the real estate industry that is next level!

Although it’s not real estate in the traditional sense, it’s all digital.

With Digital Leasing, you have the opportunity to completely walk away from your 9-5 job!

Sound too good to be true?

Of course it does!

But it isn’t…in fact, business owners wish they had this skill!

What exactly is the skill?

Well, basically you are acting as a conduit for small business to increase their bottom line.

What I mean is…

You are helping these businesses grow!

But how?

All you have to do is build and rank a website and forward certain jobs off to a business owner in town, you could even email it to them!

This works for literally any service based business… ie: tree service, plumbing, towing, etc.

How Do You Get Paid And How Much?

Simple, after you forward the jobs off to a business owner and he makes some money off of them, you simply ask to make the deal beneficial for each other.

A fair price to charge per lead, depending on the industry is 10-20%…let’s just use the tree service industry for example and go by worst case scenario.

Let’s say you build and rank the site and only 20 jobs a month come in. The average tree service job is anywhere from $500-$2000!

That means at bare minimum you have an asset worth $1000 a month!

See why they call it Digital Leasing now?

That’s a rent payment.

The great thing is how easy it is to scale. You don’t have to answer the phone…all you have to do is get the phone to ring.

Truly passive income!

The training program takes making money online to a whole other level. The owner of the program walks you through how to build and rank a site hand in hand, with the occasional voice over when he is sharing his screen.

You will learn the importance of keywords, website name, how to send call notifications via email, backlinking, etc.

Once the training program is completed you will also have access to a Facebook group where you can ask questions and be in a community with others on the same journey as you.

Digital Leasing allows you to have passive income with most of your day being spent OUT of the brick and mortar landscape.

Now, I know you probably have tons of questions…